I agree to and consent to receive news, updates, and other communications by way of commercial electronic messages (including email) from Lincoln Gold Mining Inc. I understand I may withdraw consent at any time by clicking the unsubscribe link contained in all emails from Lincoln Gold Mining Inc.

On January 6, 2025, Lincoln Gold Mining Inc. and its wholly owned subsidiary, Lincoln Resource Group Corp. (together “Lincoln”) completed the acquisition of the Bell Mountain project from Eros Resources Corp. and its wholly owned subsidiary Bell Mountain Exploration Corp., (together “Eros”), to acquire all right, title and interest in the Bell Mountain Project located in the Fairview Mining District, Churchill County, Nevada.

Lincoln completed all regulatory requirements for the acquisition, which included completing an updated Preliminary Economic Assessment (“PEA”) for the project and submitting a financial plan for the first phase of the project’s development.

Under the terms of the purchase agreement dated November 9, 2023, Lincoln issued to Eros 4,500,000 common shares in the capital of the Company to complete the closing of all the transactions related to the purchase agreement.

| Bell Mountain Facts | |

| Bell Mountain Facts | |

| Location | 54 miles southeast of Fallon Nevada, Fairview Mining District |

| Commodities | Gold and silver |

| Land | 1,463 hectares (3,616 acres) |

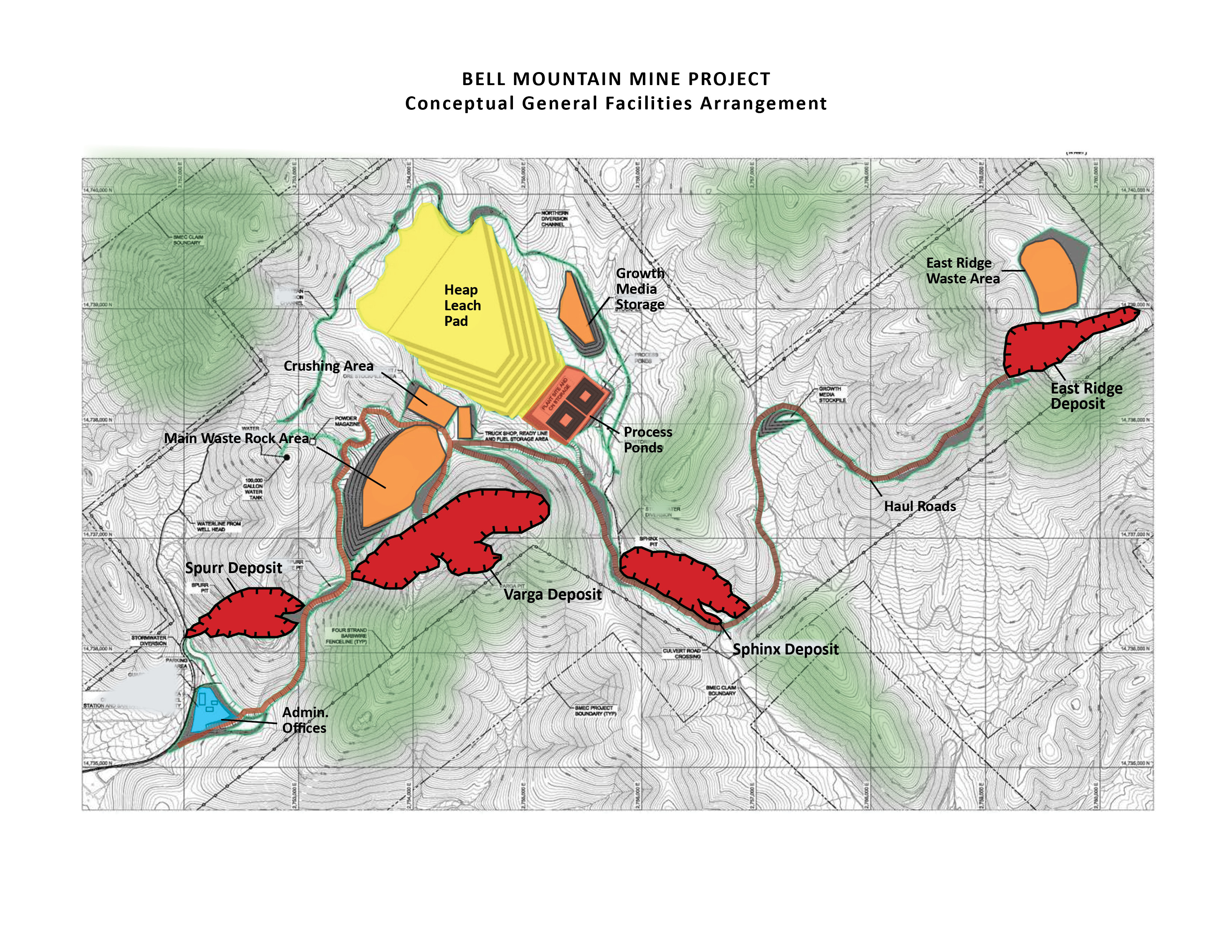

| Infrastructure | Located in a pro-mining district, good access to roads, and is topographically suitable for building heap leach pads and support facilities |

| Ownership` | 100% interest in the property |

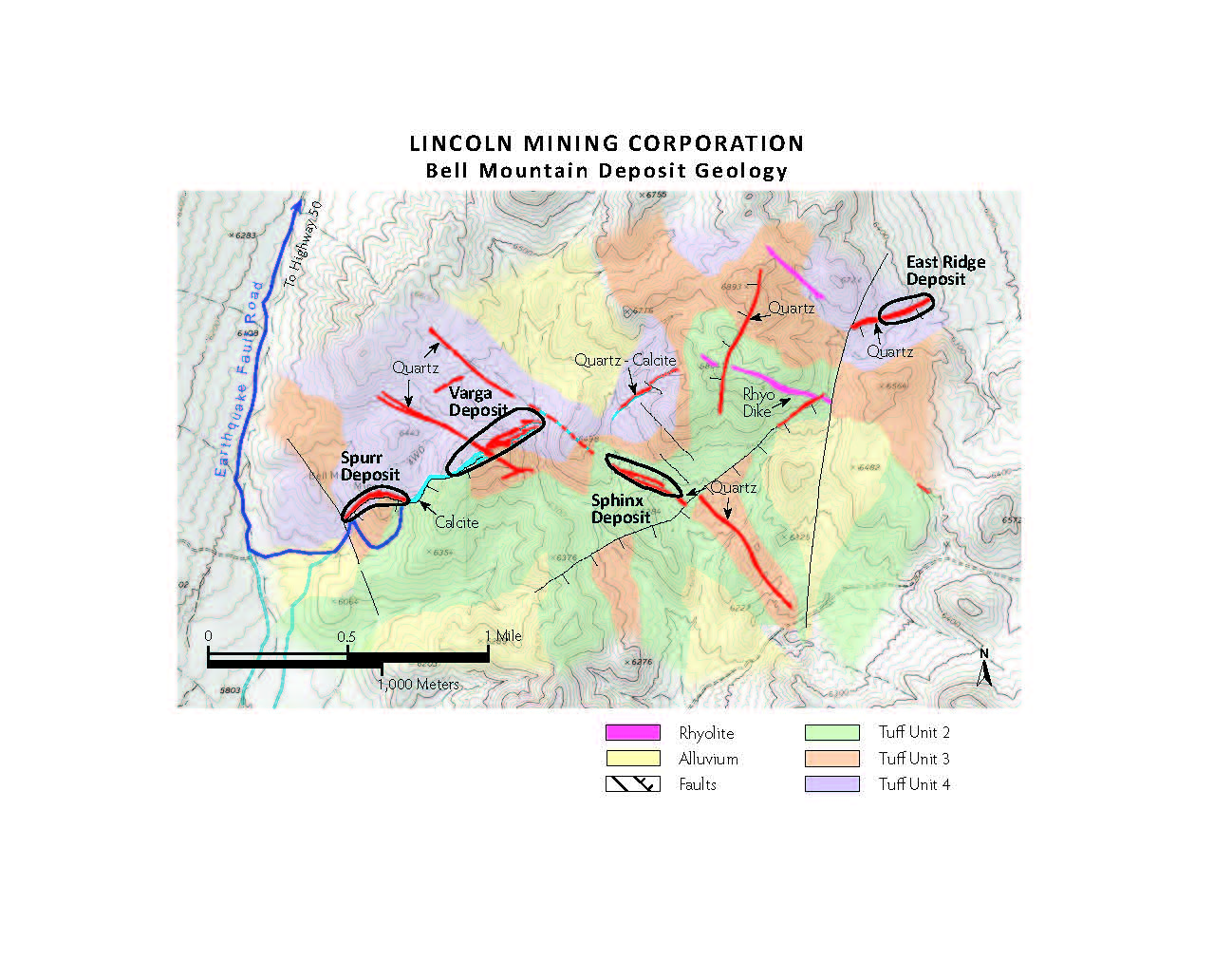

| Deposits | Comprised of four gold-silver deposits, the Spurr, Varga, Sphinx and East Ridge deposits. Epithermal calcite/quartz veins in Tertiary tuffs with subaerial volcanic centers such as the Fairview Peak caldera |

| Status | Fully permitted advanced-stage w/ near term production |

| Drilling | 297 drill holes completed consisting of 62,303 feet of drilling by 9 different operators over a period of 29 years |

| Preliminary Economic Assessment (PEA) | Updated PEA prepared by Welsh Hagen Associates of Reno, Nevada, filed on January 6, 2025 |

| Plan | Project is for open pit mine w/ heap leach processing |

| Exploration Potential | Exploration potential exists beyond current resources in several directions, especially along the ridges that support the four deposit areas. |

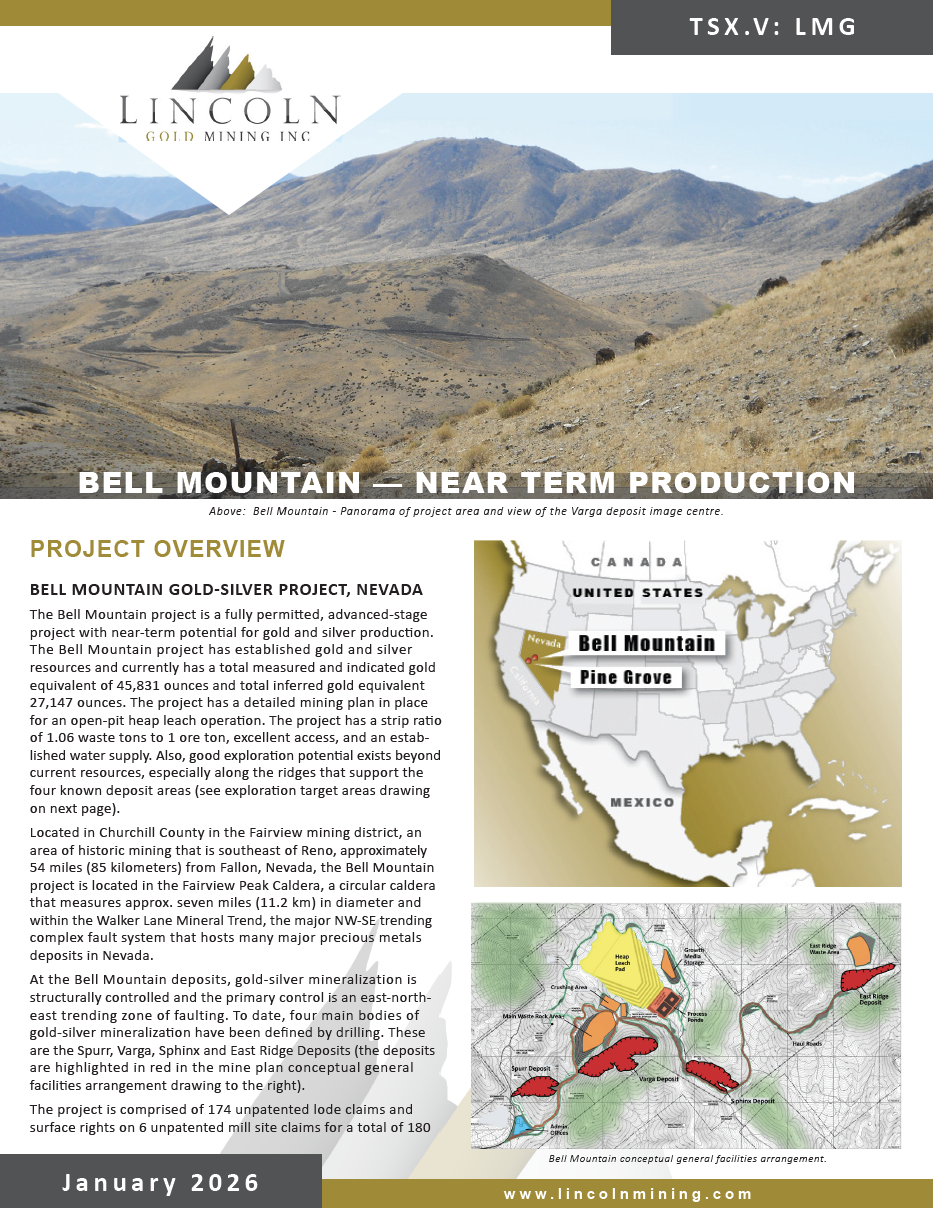

Bell Mountain - Drilling on the Sphinx Deposit

Bell Mountain Mine – Concept General Facilities Arrangement

Bell Mountain District – Deposit Geology

Lincoln Gold Mining Inc. with its subsidiary Lincoln Resource Group Corp. (Lincoln or the Company) acquired 100% interest in the Bell Mountain Gold-Silver Project from Eros Resources Corp. with its subsidiary Bell Mountain Exploration Corp. (together referred to as Eros) on January 6, 2025. Lincoln has now become the operator of the Bell Mountain Mine Project and Eros is now an insider of the Company.

The Bell Mountain project is a fully permitted advanced-stage project with near term potential for gold and silver production. The Bell Mountain project has four gold and silver deposits, the Spurr, Varga, Sphinx and East Ridge deposits, with defined resources and the project has exploration potential in all areas, especially along the ridges that support the currently defined deposit areas.

The property is in the Fairview Mining District in Churchill County, Nevada and is approximately 95 miles southeast of Reno, Nevada and 54 miles southeast of Fallon, Nevada. The project is comprised of 174 unpatented lode claims and possessory surface rights on 6 unpatented mill site claims for a total of 180 claims that cover a land package of approximately ± 1,463 hectares (± 3,616 acres). Over a period of 29 years, a total of 297 drill holes for a total of 62,303 feet have been completed at the project by several different companies. The project claims are in good standing and the project is under the jurisdiction of the Bureau of Land Management and the State of Nevada.

Eros acquired 100% interest in the property through its U.S. subsidiary Bell Mountain Resources Corp. in June 2017. Eros conducted work on the property that included permitting, geological mapping, and surface sampling. In October 2017, Welsh Hagan Associates completed a PEA that disclosed a preliminary equivalent gold and silver resource estimate of measured & indicated and inferred resource categories for the Bell Mountain project. The Bell Mountain project is fully permitted with a mining plan for a cost-effective open pit heap leach mine. The project is ready to advance through the construction phase and into production.

As a condition for the acquisition, Lincoln completed an Updated Preliminary Economic Assessment (PEA) and submitted a financial plan for the project to the TSX Venture Exchange (TSXV). The PEA was prepared by Welsh Hagen Associates of Reno, Nevada and the PEA was filed on www.sedarplus.ca on January 6, 2025. The technical report has been posted to the website under the reports section. The updated PEA provides a basis to estimate project operating and capital costs and establish a projection of conceptually extractable resources including measured, indicated and inferred categories as permitted under NI 43-101. As Lincoln is now the operator of the Bell Mountain project, a work program can now commence at the project as recommended by the PEA.

Geology & Mineralization

The Bell Mountain property lies within the Fairview mining district on the east side of the Fairview Range. In the Fairview Range, the pre-Tertiary basement consists of limited exposures of Jurassic metasedimentary rocks, primarily amphibolite, biotite schist and quartzite, which are cut by a Cretaceous granodiorite intrusion. These rocks are overlain by a complex series of intermediate to rhyolitic lavas, ashflow tuffs, volcaniclastic sediments and small dacitic to rhyolitic intrusive domes and dikes (see photos and map section illustrating regional geology).

In early Miocene times, approximately 19.2 Ma, the Fairview Peak caldera formed. The circular caldera measures approximately seven miles (11.2 km) in diameter. It is filled with a monotonous sequence of densely to poorly welded rhyolitic ashflow tuffs. Several rhyolite domes were emplaced along the ring fracture of the caldera. There are a few post-caldera glassy rhyolite dikes cutting the intra-caldera tuffs. The late dikes tend to follow east-west, east-northeast and northwest structural trends. Most known veins in the district follow these trends. The intra-caldera tuff sequence exhibits pervasive argillic alteration and structurally controlled to locally pervasive silicification. The Bell Mountain vein system is located within this intra-caldera tuff sequence and is hosted by one of the silicified east-northeast Trending structural zones.

To date, four main bodies of gold-silver mineralization (Spurr, Varga, Sphinx and East Ridge) have been defined by drilling. The larger Spurr and Varga zones are situated along the principal NE structural trend (Varga-Spurr fault), the Sphinx zone is controlled by a WNW cross structure (Sphinx fault). The East Ridge zone is controlled by NE striking structure. The East Ridge Deposit consists of a single east-northeast trending quartz-calcite vein which dips steeply to the south.

Mineral Resources at Bell Mountain Property

The Resource Statement as report in the Updated Preliminary Economic Assessment (PEA) for the Bell Mountain Project, Churchill County, Nevada, prepared by Welsh Hagan Associates dated January 6, 2025, is shown below. The resources were classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) definitions and are reported as measured, indicated and inferred. To comply with the CIM definition of “reasonable prospects of economic extraction”, only those blocks contained within a designed pit shell as Mineral Resources. To view the entire PEA, go to the Bell Mountain reports section on this website.

Exploration Drilling

The PEA reports that signification exploration potential exists beyond current resources and recommends that infill drilling be conducted at the Spurr, Varga, Sphinx and East Ridge deposit areas within the constraining pit shells where there are gaps in the drilling data. Step out drilling is also recommended in all the known mineral resource areas to test for extensions to mineralization where current drillhole data is sparce. Secondary step out drilling in current mineral resource areas additional exploration in prospective mineralized areas outside of the known mineral resource areas within the project area is also recommended.

Going Forward

Advancing the development of the Bell Mountain project will be the major focus of the Company’s activities for the next few months. Lincoln is proceeding with discussions with various financial institutions for the capital required to move Bell Mountain into the construction phase. It is expected that it will take approximately eight months to complete construction after which production will commence. As funding becomes available, exploration drilling programs will be developed at the same time to potentially increase the size of the resources base, especially around all the four current deposit structures.

Updated Preliminary Economic Assessment

Resource Statement for the Bell Mountain Project, Churchill County, Nevada

| Spurr at 0.0071 AuEq cutoff | |||||||

| Classification | Tons | Gold | Silver | Gold Equivalent | |||

| (x1000) | (opt) | (oz) | (opt) | (oz) | (opt) | (oz) | |

| Measured | 282.5 | 0.029 | 8,273 | 0.99 | 280,415 | 0.034 | 9,494 |

| Indicated | 350.2 | 0.024 | 8,487 | 0.84 | 295,254 | 0.028 | 9,772 |

| M&I | 632.7 | 0.026 | 16,760 | 0.91 | 575,670 | 0.030 | 19,265 |

| Inferred | 113.7 | 0.017 | 1,966 | 0.63 | 71,922 | 0.020 | 2,279 |

| Varga at 0.0087 AuEq cutoff | |||||||

| Classification | Tons | Gold | Silver | Gold Equivalent | |||

| (x1000) | (opt) | (oz) | (opt) | (oz) | (opt) | (oz) | |

| Measured | 421.9 | 0.022 | 9,208 | 0.38 | 159,064 | 0.023 | 9,574 |

| Indicated | 664.7 | 0.022 | 14,414 | 0.35 | 229,748 | 0.022 | 14,941 |

| M&I | 1086.7 | 0.022 | 23,622 | 0.36 | 388,812 | 0.023 | 24,515 |

| Inferred | 428.4 | 0.020 | 8,533 | 0.35 | 150,207 | 0.021 | 8,878 |

| Sphinx at 0.0075 AuEq cutoff | |||||||

| Classification | Tons | Gold | Silver | Gold Equivalent | |||

| (x1000) | (opt) | (oz) | (opt) | (oz) | (opt) | (oz) | |

| Measured | 17.5 | 0.032 | 570 | 0.99 | 17,314 | 0.034 | 597 |

| Indicated | 9.1 | 0.019 | 175 | 0.49 | 4,453 | 0.020 | 181 |

| M&I | 26.6 | 0.028 | 745 | 0.82 | 21,767 | 0.029 | 778 |

| Inferred | 222.7 | 0.022 | 4,845 | 0.53 | 116,957 | 0.023 | 5,025 |

| East Ridge at 0.0075 AuEq cutoff | |||||||

| Classification | Tons | Gold | Silver | Gold Equivalent | |||

| (x1000) | (opt) | (oz) | (opt) | (oz) | (opt) | (oz) | |

| Measured | 0.0 | 0.000 | - | 0.00 | - | 0.000 | - |

| Indicated | 40.6 | 0.030 | 1,214 | 0.95 | 38,410 | 0.031 | 1,274 |

| M&I | 40.6 | 0.030 | 1,214 | 0.95 | 38,410 | 0.031 | 1,274 |

| Inferred | 355.8 | 0.029 | 10,417 | 1.00 | 356,245 | 0.031 | 10,965 |

Notes: Open pit optimization was used to determine potentially mineable tonnage. Measured, Indicated and Inferred mineral classification was determined according to CIM Standards. Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. The 2024 Measured, Indicated and Inferred Mineral Resource is constrained within $1,950 gold and $24.00 silver optimized pit shells using the CSM Mineflow™ program. The base case estimate applies an AuEq cutoff grade of 0.0087 oz/t for Varga, 0.0071 oz/t for Spurr, and 0.0075 oz/t for both Sphinx and East Ridge. Metallurgical recoveries used for the cutoff calculations were 83.7% on gold and 29.6% on silver for Spurr, 68.6% on gold and 12.8% on silver for Varga and 80% on gold and 10% on silver for Sphinx and East Ridge.