I agree to and consent to receive news, updates, and other communications by way of commercial electronic messages (including email) from Lincoln Gold Mining Inc. I understand I may withdraw consent at any time by clicking the unsubscribe link contained in all emails from Lincoln Gold Mining Inc.

Project Factsheet

Pine Grove – Wilson deposit drill program

Pine Grove – Wilson deposit drill program

The Company's immediate objective is to finalize permitting at the advanced-stage Pine Grove gold project in Lyon County, Nevada. Lincoln filed an Amended and Restated NI 43-101 Preliminary Economic Assessment for the Pine Grove project in February 2015. The report is available for viewing in the Technical Report section. The Pine Grove project hosts two gold deposits: the Wilson deposit and the Wheeler deposit.

Drill programs, survey work, geotechnical work and field exploration programs have identified new target areas for the project. Lincoln in mid-2025 will initiate the final permitting needed to take the project to production.

| Pine Grove Facts | |

| Location | Pine Grove Hills, Lyon County, Nevada |

| Commodities | Gold |

| Land | 7.2 square miles (18.1 square kilometers) |

| Ownership | Lincoln Gold Mining Inc. holds7.2 sq. miles of patented and staked claims. |

| Deposits | Two gold deposits in the Pine Grove fault zone |

| Status | Advanced-stage w/ near term production potential. Permitting in Progress. |

| Drilling | 280 Holes 94,380 ft. |

| NI 43-101 Technical Report* | NI 43-101 Preliminary Economic Assessment (“PEA”) filed on SEDAR February 16, 2015 |

| Plan | Open-pit mine w/ heap leach processing |

| Exploration Potential | Significant exploration potential exists beyond current resources within the property boundary |

| Measured & Indicated Gold Resources * | 5,553,937 Tons grading 0.03 opt (0.93 g/t) gold at 0.007 opt gold cutoff grade * (heap leach) & 334,170 Tons grading 0.18 opt (6.26 g/t) gold at 0.10 opt gold cut-off grade * (mill with gravity circuit) |

| Inferred Gold Resources * | 43,450 Tons grading 0.03 opt (1.04 g/t) gold at 0.007 opt gold cut-off grade * |

| Strip Ratio | 2.3:1 |

| Gold Recovery | 75% |

Pine Grove – Core Drilling Analysis

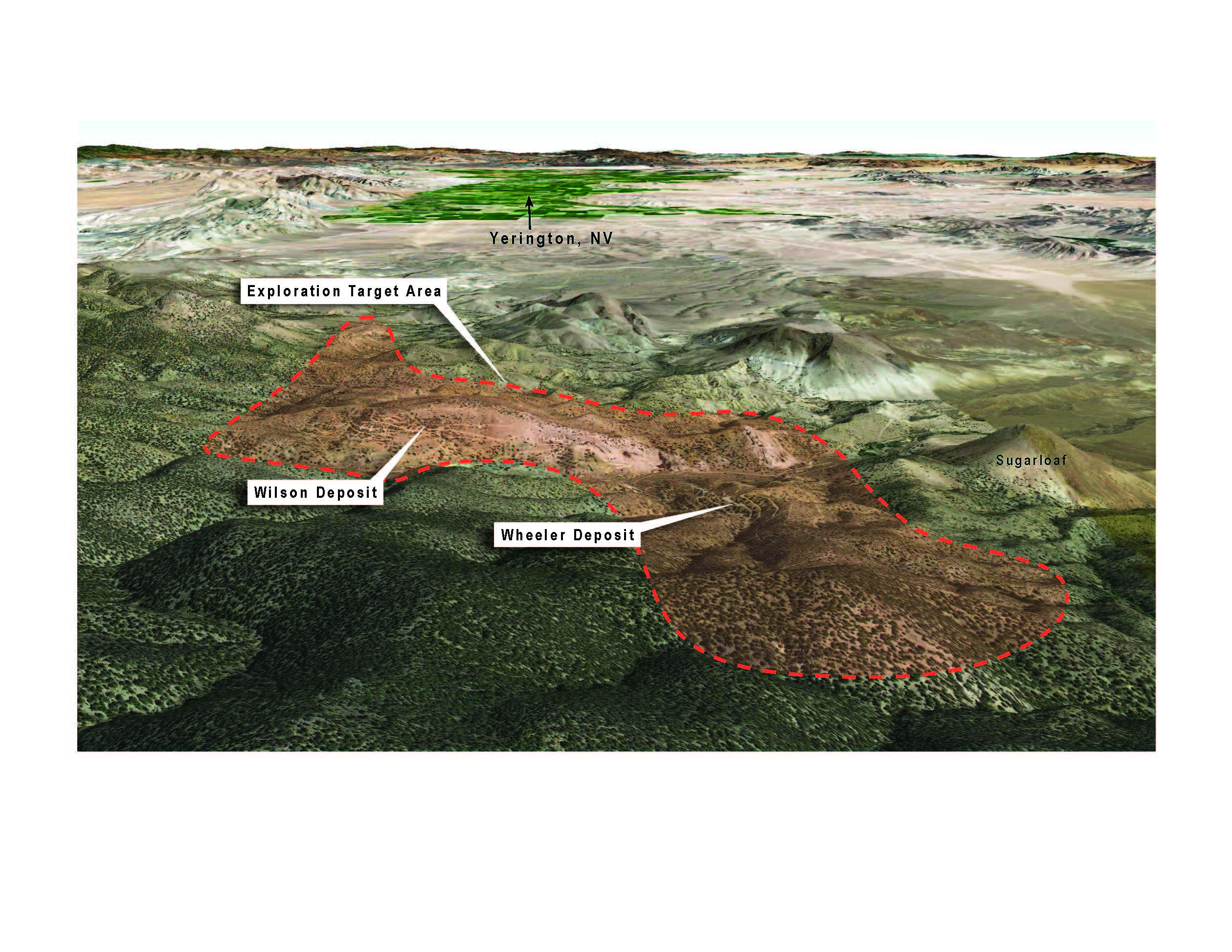

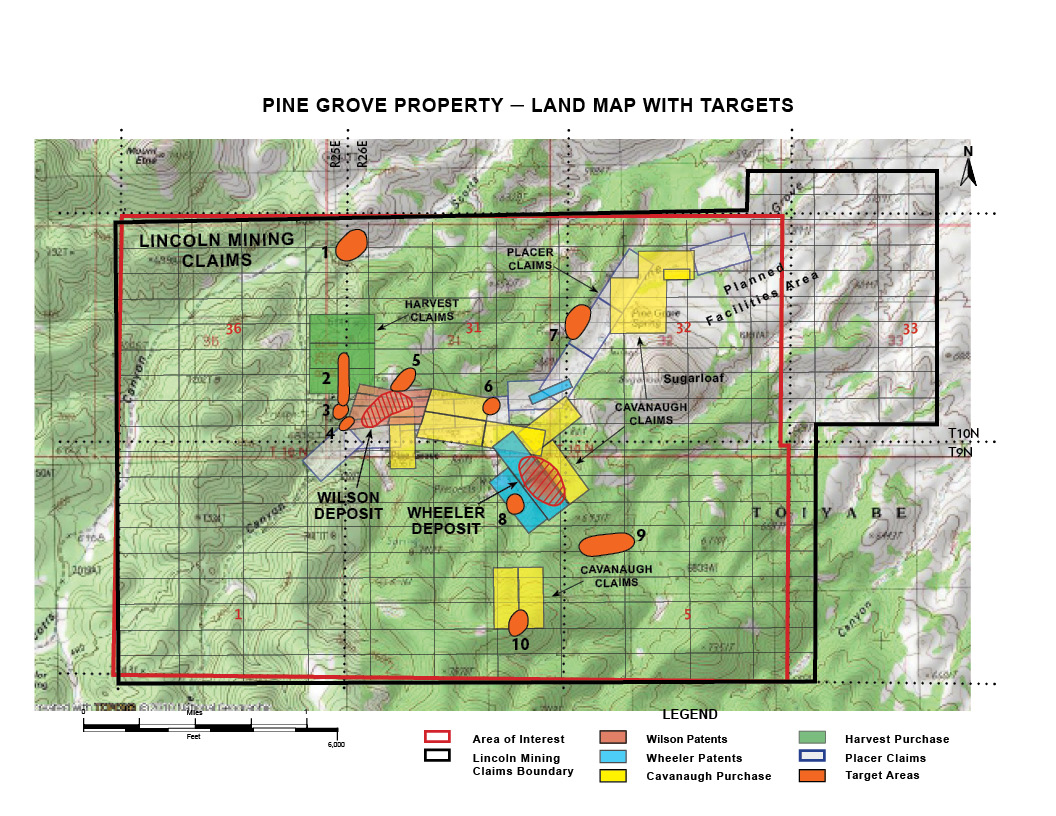

Pine Grove claims and exploration target areas

Pine Grove general exploration target area

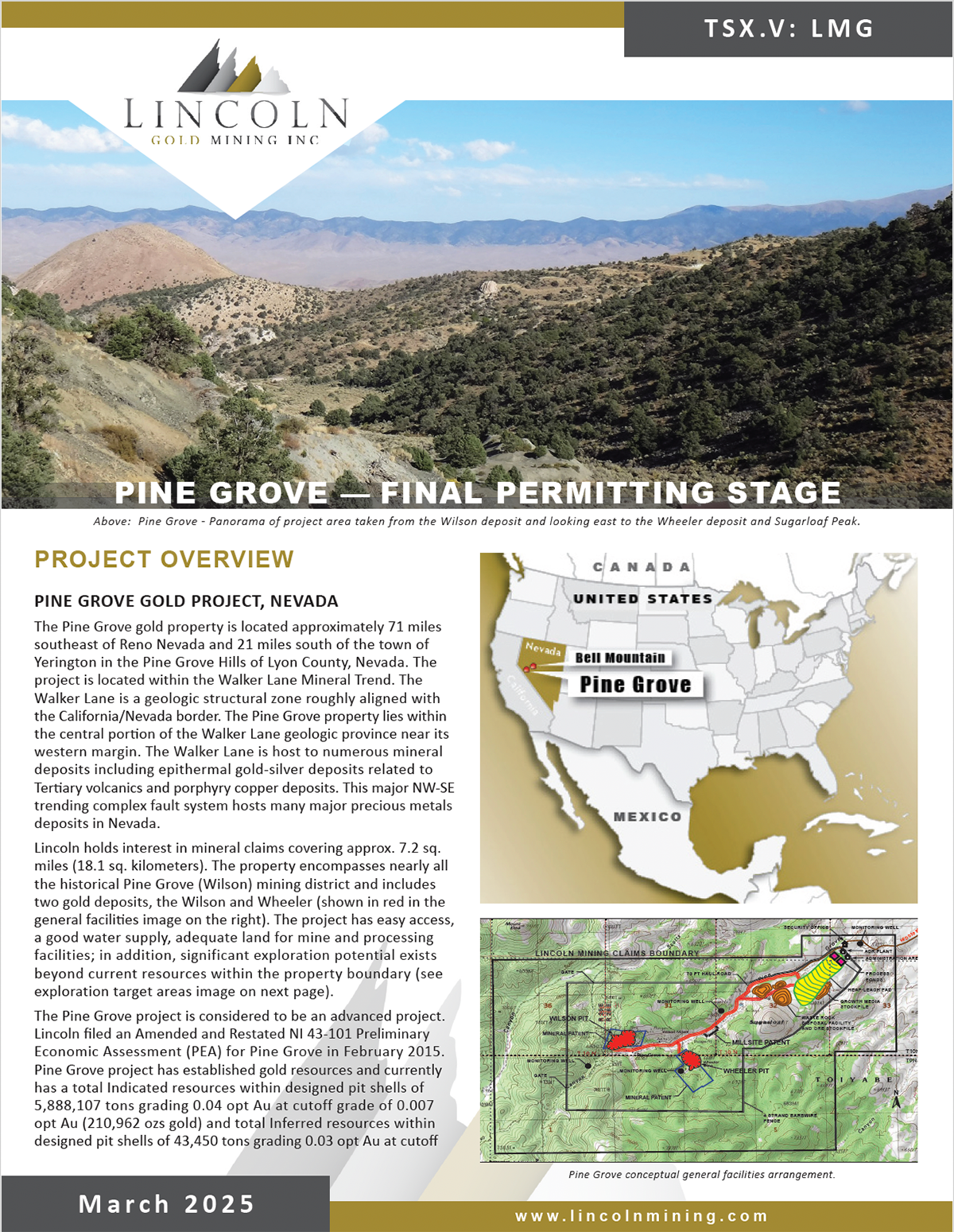

The Pine Grove gold property is located approximately 70 miles southeast of Reno Nevada and 21 miles south of the farming and mining town of Yerington in the Pine Grove Hills, Humboldt-Toiyabe National Forest, Lyon County, western Nevada. Access is excellent via paved Nevada State Highway 208 to the East Walker Road (gravel) southward to the Pine Grove drainage and then 4 miles by dirt road onto the center of the property. The property encompasses nearly all the Pine Grove mining district.

Lincoln controls 100% mineral interest in claims covering nearly 7.2 square miles (18.1 square kilometers). The Company holds a mining lease on the Wheeler mine (4 patented claims), the Wilson mine (8 patented claims), as well as 243 unpatented claims (lode, placer and millsite) that surround the patented claims. The Company's land position covers significant gold mineralization, numerous exploration targets, and adequate land for mine and processing facilities. The patented claims (private property) are under the jurisdiction of the State of Nevada. Unpatented claims are under the jurisdiction of the U.S. Forest Service. Adequate water sources have also been acquired.

While our focus at this time is getting the Bell Mountain gold project into production we are also the final stages of the permitting process at Pine Grove will be undertaken funding becomes available. A NI 43-101 resource update is planned for the project once all permitting has been completed. With encouraging results received from the recent drill program, further work programs will be developed with the intent to increase the current gold mineral resource at Pine Grove. Currently ten drill targets have been identified for further exploration at the Pine Grove where significant gold has been mined in the past.

Geology & Mineralization

The Pine Gove district is dominated by Jurassic granodiorite and its variations. The granodiorite has undergone potassium alteration and locally displays abundant secondary biotite. Dikes and sills of various compositions (andesite, dacite, rhyolite) have intruded the granodiorite within the Pine Grove fault zone. These dikes and sills are thought to be the source of the gold mineralization. Native gold is associated with small quartz veinlets, stockworks, and other disseminations hosted primarily in the granodiorite. Where unoxidized, mineralized quartz veinlets contain minor pyrite, minor chalcopyrite, pyrrhotite, and native gold. Elevated copper is present. The style of mineralization appears to be of the "Shear Zone" sub-type of Plutonic-Related Gold Quartz Veins and Veinlets." The shallow-dipping, Pine Grove fault zone is approximately 600 ft wide and at least 1 mile long and appears to be the primary structural control for gold mineralization. The fault zone is an excellent exploration target. Significant gold mineralization occurs as stacked, sub-horizontal zones and pods ranging from 5 to 70 ft in thickness. Most of the mineralization drilled to date is shallow, less than 200 ft in depth. Although high-grade gold (>0.5 oz per ton) was the target in the 1800s, the lower grade gold mineralization ranging from 0.01 to >0.1 oz per gold is the present material of economic interest.

2021 Drill Program and Assaying Summary

During November and December of 2021, five NQ size core holes were drilled at the Wilson deposit at Pine Grove. Three sites were selected to twin existing RC holes to compare geology and assay data, and two sites were selected as step out holes to test for new mineralization. Because of the Covid outbreak, the subsequent lack of financing and, most recently, our focus on the exciting acquisition of the fully permitted Bell Mountain gold property we have only just completed the analyses of this drilling.

As such, core logging, sampling and assaying were completed in September 2024. The core was also photographed. Samples were analyzed at Paragon Geochemical in Sparks, Nevada for 33 elements including gold, silver and copper. Gold was assayed by 30g fire assay with gravimetric finish and reported in ppm. Gold and silver values reported by Paragon in ppm have been converted to Troy ounces per short ton, which is the standard used by Lincoln at Pine Grove. A news release dated February 26, 2025 was issued covering the drilling and analyses of this work.

Core Hole Assay and Lithology Data for Twinned Holes

Core Hole WL-120NQ is twin of Teck RC hole WL-29 and is offset approximately 20 feet to the south. The five intercepts of gold mineralization that were encountered are:

1.) 135.0-140.0’ (5.0’ @ 0.011)

2.) 145.5-149.0’ (3.5’ @ 0.010)

3.) 155.0-160.5’ (5.5’ @ 0.014)

4.) 188.0-194.5’ (6.5’ @ 0.062)

5.) 202.5-209.0’ (6.5’ @ 0.035)

Both holes, the original Teck drilling and Lincoln’s recent core hole, cut a mineralized zone at depth from 135 to 160 feet in the granodiorite host rock near the contact with a rhyolite porphyry dike. Gold values in the original RC hole averaged 0.036 opt. over the 25 foot length while the recent core hole had three samples totaling 14 feet averaging 0.012 opt. From 188 down to 209 feet the core hole cut two mineralized zones that were not present in the RC hole.

The lithologic units logged in the core hole include feldspar porphyry, rhyolite porphyry and granodiorite and are consistent with the current geologic model on the section.

Core Hole WL-121NQ is a twin of Lincoln RC hole WL-102 and is offset approximately 20 feet to the south. The six intercepts of mineralization that were encountered are:

1.) 35.5-40.0’ (4.5’ @ 0.006)

2.) 84.0-89.0’ (5.0’ @ 0.015)

3.) 94.0-103.5’ (9.5’ @ 0.042)

4.) 108.5-119.0’ (10.5’ @ 0.023)

123.0-130.0’ (mine workings)

5.) 130.0-136.0’ (6.0’ @ 0.011)

6.) 148.2-159.5’ (11.3’ @ 0.019)

The gold mineralization occurs within the granodiorite host rock. The intercept at 35.5 feet is within a 25-foot zone of low values (>0.010 opt.) in WL-102 and did not see the 5.0-foot assay of 0.133 at 55 feet. The five intercepts in the lower half of the hole from 84 feet down to 159.5 feet occur above and below mine workings, and show higher values where the RC hole only shows a couple of values around mine workings. This zone of mineralization in the core hole should add good grade ore blocks when the model is updated.

Lithologic units and the oxide-sulfide boundary logged in the core hole are consistent with the geologic model on the section.

Core Hole WL-122NQ is a twin of Teck hole WL-40 and is offset approximately 20 feet to the south. The four intercepts of mineralization that were encountered are:

1.) 30.0-38.0’ (8.0’ @ 0.011 opt.)

2.) 110.0-112.0’ (2.0’ @ 0.149 opt.)

3.) 119.0-122.5’ (3.5’ @ 0.035 opt.)

4.) 159.0-166.5’ (7.5’ @ 0.006 opt.)

The intercept at 30 feet is in the granodiorite along a rhyolite porphyry dike contact where RC hole WL-40 shows values of 0.004 or less.

Between 110 to 122.5 feet there are two narrow intercepts with good grade in the core where the RC hole WL-40 shows 0.020 over a 35 foot zone. Values in the core hole are consistent with ore blocks shown in the grade model and the 8 feet of .0.011 opt. Au in the upper part of the hole may add some ore blocks to the model.

The lithology logged in the core hole is consistent with the present geologic model and granodiorite and rhyolite porphyry are the only two rock types logged in the hole.

Discussions of Twin Hole Drilling

The three core holes that were drilled to compare assay and geologic date with existing RC holes encountered gold mineralization within the same mineralized zone as the twinned RC holes and in some cases encountered mineralization not seen in the RC holes. Core drilling by Lincoln at Pine Grove prior to the 2021 program include four each at Wheeler and Wilson. Results of these programs comparing RC to core have been addressed in the PEA dated February 4, 2015 by Welsh-Hagen where they state

“The results of the comparisons show that coherent zones of gold mineralization are present in both RC and core hole twins drilled at the Wheeler and Wilson deposits. As is typical of many hydrothermal gold deposits, the results of core vs. RC comparison assays of samples from Pine Grove indicates that the range of precision of the values is wide, but still acceptable. The comparisons suggest that the result reflect the relatively coarse nature of the gold particles and the natural variability of the distribution of the gold particles in the rock, rather than to sampling, preparation, or assaying problems.”

In addition, a statistical analysis of drill hole data by Welsh-Hagen has shown that there is a strong correlation between grade and structural preparation of host rocks, in particular, faults and fractures”. Grade is dependent on density of fractures, narrow shears with gouge and quartz veining. These features can very over short distances. The core drilling has found mineralization in the same zones as seen in the RC drilling and has also found mineralization not seen in the RC holes. The difference in widths and grade is a function of the density of the gold bearing structures over the twin hole offset distance.

The twin hole core drilling confirms that the geologic model based nearly entirely on Reverse Circulation drilling at the Wilson is a good representation of the deposit geology.

Results for Step-Out Drilling

The two core holes designated as step out holes are WL-118NQ and WL-119NQ.

Core hole WL-118NQ is approximately 100 feet north of Lincoln RC hole WL-85 and encountered three mineralized zones with low grade gold values:

1.) 132.0-134.5’ (2.5’ @ 0.008)

2.) 175.0-195.0’ (20.0’ @ 0.009)

3.) 205.0-215.5’ (10.5’ @ 0.009)

All of the intercepts occur within the granodiorite host or along the granodiorite-rhyolite porphyry contact, which is consistent with the geologic model.

Core hole WL-119NQ is a step out hole approximately 160 feet north of Teck RC hole WL-39. The four intercepts of gold mineralization that were encountered are:

1.) 96.4-100.5’ (4.1’ @ 0.024)

2.) 106.0-111.5’ (5.5’ @ 0.006)

3.) 182.5-187.5’ (5.0’ @ 0.014)

4.) 208.0-213.0’ (5.0’ @ 0.015)

The depths of mineralization and the gold values encountered fit well with the blocks as predicted by the grade model. The gold mineralization occurs within the granodiorite host near contacts with feldspar porphyry and dacite dikes, which is consistent with the geologic model on the section.

The Company is pleased with the results of the drill program and as funding for exploration becomes available, additional drill programs will be developed with the intent of increasing Pine Grove’s gold mineral resources.

QA/QC:

During November and December of 2021, five NQ core holes were drilled by KB Drilling of Mound House, Nevada. At the end of each shift the contractor delivered the core boxes to the supervisor project geologist at the secure Lincoln field office and sample storage warehouse in Yerington, Nevada.

During August 2024 the core was photographed, logged, and cut at the Lincoln Resources warehouse. The samples selected for analysis were split using a MK Diamond wet tile saw. The QAQC protocols included the insertion of Certified Reference Material as well as a coarse blank material. Samples were analyzed at Paragon Geochemical in Sparks.

Mineral Resources

Resource estimate reported in the Amended and Restated NI 43-101 Preliminary Economic Assessment for the Pine Grove Project, Lyon County, Nevada, dated February 4, 2015, prepared by Welsh Hagan Associates and filed on SEDAR on February 16, 2015 are reported below. The resources were classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) definitions and are reported as measured, indicated (Table 1) and inferred (Table 2). To comply with the CIM definition of "reasonable prospects for economic extraction", only those blocks contained within a designed pit shell as Mineral Resources. A link to the technical report is provided below.

The PEA reports that significant exploration potential exists beyond current resources and recommends that infill and offset drilling be performed around the Wilson deposit, deep drilling in the Wheeler deposit, and expansion exploration drilling in known outlying anomalous intercepts.

As funding becomes available, additional exploration drilling programs will be developed to potentially increase the size of the resource base. These programs will test numerous prospective areas of the Pine Grove property. District exploration may include additional soil geochemical surveys, continue geologic mapping, and drilling on new and existing targets. Immediate work will focus on completing environmental baseline reports, water well and condemnation drill programs to finalize permitting. An updated NI 43-101 technical report and an updated Pre-Feasibility report is also planned.

Table 1: Total Measured and Indicated Gold Resources Estimate at Pine Grove:

| At 0.007 opt Au cutoff | Tons (000S) |

Tonnes (000S) |

Gold | |||||

| Cutoff Grade (opt) |

Cutoff Grade (g/t) |

Average Grade | Ounces | Grams | ||||

| Gold (opt) |

Gold (g/t) |

|||||||

| Indicated (Heap leach) | 5,553,937 | 5,038,448 | 0.007 | 0.24 | 0.03 | 0.93 | 149,956 | 4,664,082 |

| Indicated (High grade mill) | 334,170 | 303,154 | 0.007 | 3.43 | 0.18 | 6.26 | 61,006 | 1,897,470 |

| Total Indicated | 5,888,107 | 5,341,602 | 0.007 | 0.04 | 1.23 | 210,962 | 6,561,552 | |

Table 2: Total Inferred Gold Resource Estimate at Pine Grove:

| At 0.007 opt Au cutoff | Tons (000S) |

Tonnes (000S) |

Gold | |||||

| Cutoff Grade (opt) |

Cutoff Grade (g/t) |

Average Grade | Ounces | Grams | ||||

| Gold (opt) |

Gold (g/t) |

|||||||

| Inferred | 43,450 | 39,520 | 0.007 | 0.24 | 0.03 | 1.04 | 1,324 | 41,180 |

Notes to Tables 1 & 2:

- Mineral Resources are reported using a gold price of $1425/oz.

- Rounding of tons and contained gold results in apparent differences in totals and are in accordance with reporting guidelines.

- Contained metal estimates remain subject to factors such as mining dilution and process recovery losses.

- Mineral Resources that are not mineral reserves do not have demonstrated economic viability.

Pine Grove Photo Gallery

Pine Grove Map Gallery